The Duty of a Repayment Gateway in Streamlining Shopping Settlements and Enhancing Customer Experience

The integration of a payment portal is critical in the ecommerce landscape, serving as a safe channel between vendors and consumers. By allowing real-time deal processing and supporting a variety of settlement methods, these gateways not just minimize cart desertion however likewise enhance general customer complete satisfaction. Additionally, their emphasis on security and openness cultivates count on in a progressively competitive market. As we explore the multifaceted benefits of repayment gateways, it comes to be vital to check out how these systems can even more evolve to fulfill the demands of both organizations and consumers alike.

Recognizing Settlement Entrances

A payment entrance works as a vital intermediary in the e-commerce deal procedure, facilitating the safe transfer of payment info in between customers and vendors. 2D Payment Gateway. It makes it possible for online companies to approve numerous forms of repayment, consisting of charge card, debit cards, and digital purses, therefore widening their consumer base. The gateway operates by encrypting sensitive info, such as card information, to ensure that data is transferred safely over the net, reducing the risk of scams and information violations

When a consumer launches a purchase, the payment gateway captures and forwards the transaction data to the suitable banks for consent. This procedure is generally seamless and occurs within seconds, providing customers with a fluid shopping experience. Payment gateways play an essential duty in compliance with industry standards, such as PCI DSS (Settlement Card Sector Data Safety And Security Standard), which mandates strict protection actions for processing card payments.

Understanding the mechanics of repayment entrances is important for both merchants and customers, as it directly impacts transaction performance and client trust. By making certain safe and secure and effective deals, payment portals contribute significantly to the general success of e-commerce organizations in today's digital landscape.

Trick Functions of Payment Entrances

Several essential features define the performance of repayment portals in ecommerce, ensuring both safety and security and convenience for individuals. Among the most essential functions is durable protection procedures, consisting of encryption and tokenization, which secure sensitive client information throughout purchases. This is crucial in promoting trust fund between merchants and consumers.

Furthermore, real-time transaction handling is important for guaranteeing that payments are finished swiftly, minimizing cart desertion prices. Payment portals likewise provide fraudulence detection tools, which check deals for suspicious task, additional safeguarding both sellers and consumers.

Advantages for Ecommerce Businesses

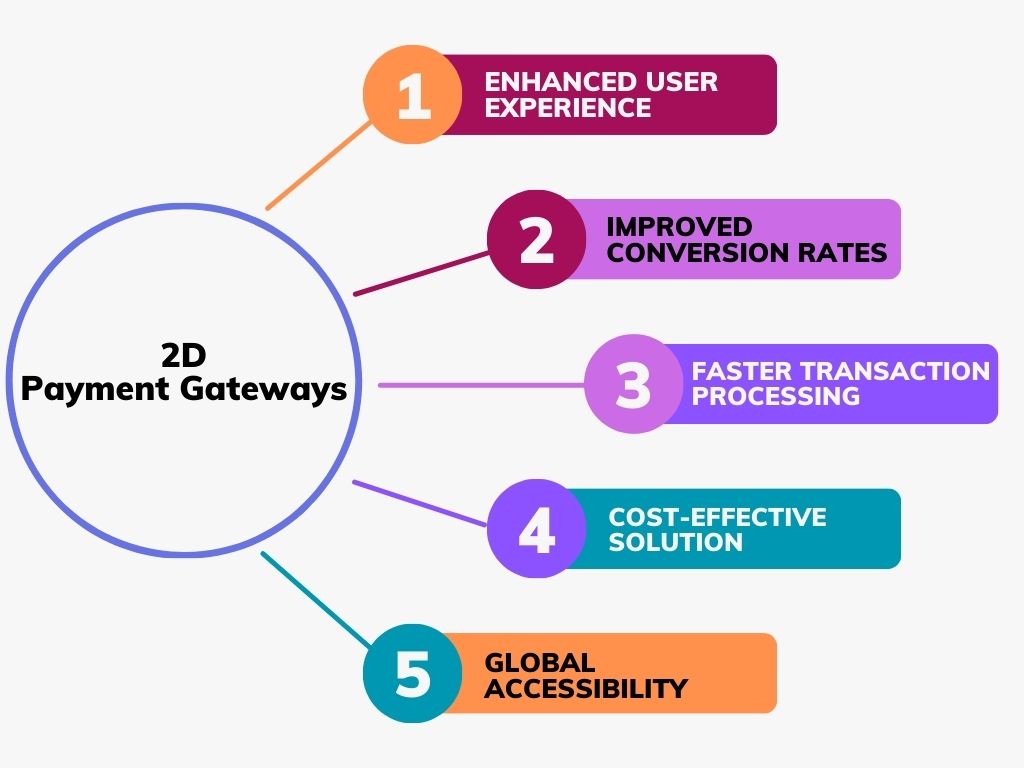

Many benefits emerge from integrating repayment gateways right into e-commerce organizations, substantially enhancing operational effectiveness and customer contentment. Repayment portals help with smooth purchases by safely processing settlements in real-time. This capability minimizes the chance of cart abandonment, as clients can promptly complete their purchases without unnecessary hold-ups.

Additionally, settlement gateways sustain multiple repayment techniques, suiting a diverse series of client choices. This versatility not just brings in a broader customer base however likewise cultivates commitment among existing clients, as they feel valued when used their recommended payment choices.

In addition, the combination of a payment gateway typically results in enhanced protection functions, such as encryption and fraudulence discovery. These procedures secure sensitive customer info, thus building depend on and integrity for the ecommerce brand.

In addition, automating repayment procedures with gateways reduces manual work for personnel, permitting them to concentrate on critical efforts instead of routine tasks. This functional efficiency equates into expense financial savings and enhanced source appropriation.

Enhancing User Experience

Incorporating an effective repayment portal is important for boosting individual experience in shopping. A seamless and reliable repayment procedure not only develops consumer count on yet also reduces cart desertion prices. By offering numerous repayment choices, such as bank card, electronic wallets, and bank transfers, services deal with diverse client choices, therefore improving complete satisfaction.

Additionally, a straightforward interface is vital. Settlement portals that supply intuitive navigation and clear instructions allow consumers to complete transactions rapidly and effortlessly. This simplicity of use is crucial, particularly for mobile customers, that call for maximized experiences customized to smaller sized displays.

Security attributes play a substantial role in user experience as well. Advanced security and fraudulence discovery systems guarantee clients that their sensitive data is protected, cultivating self-confidence in the deal process. In addition, clear interaction pertaining to policies and costs boosts reputation and reduces possible stress.

Future Fads in Repayment Processing

As shopping proceeds to progress, so do the fads and innovations shaping payment handling (2D Payment Gateway). The future of payment processing is noted by several transformative fads that guarantee to enhance performance and individual complete satisfaction. One considerable trend is the rise of fabricated knowledge (AI) and maker learning, which are being significantly integrated into payment gateways to strengthen safety and security with sophisticated fraud discovery and risk evaluation

Furthermore, the fostering of cryptocurrencies is acquiring grip, with more organizations checking Get the facts out blockchain modern technology as a practical choice to traditional settlement methods. This shift not just offers reduced purchase fees however also attract an expanding demographic that values decentralization and personal privacy.

Contactless payments and mobile purses are ending up being mainstream, driven by the need for faster, a lot more hassle-free transaction methods. This trend is more sustained by the enhancing occurrence of NFC-enabled tools, enabling seamless transactions with just a tap.

Finally, the focus on governing conformity and data protection will shape settlement handling approaches, as services make every effort to build depend on with customers while sticking to advancing lawful structures. These fads collectively suggest a future where repayment handling is not just quicker and extra safe and secure yet additionally much more straightened with customer assumptions.

Final Thought

To conclude, payment gateways function as vital elements in the shopping community, promoting secure and efficient purchase processing. By using varied payment options and focusing on customer experience, these entrances substantially lower cart abandonment and boost consumer complete satisfaction. The recurring evolution of repayment modern technologies and safety actions will certainly further strengthen their function, guaranteeing that shopping businesses can meet the demands of progressively advanced consumers while promoting depend on and integrity in on the internet deals.

By making it possible for click for source real-time transaction processing and supporting a variety of repayment techniques, these entrances not just alleviate cart desertion however likewise boost total consumer satisfaction.A payment Continued portal offers as a crucial intermediary in the e-commerce purchase process, helping with the protected transfer of payment information in between vendors and customers. Repayment gateways play a pivotal duty in conformity with market standards, such as PCI DSS (Payment Card Sector Data Protection Criterion), which mandates rigorous safety measures for processing card settlements.

A functional repayment gateway suits credit scores and debit cards, digital pocketbooks, and alternate payment approaches, providing to diverse consumer preferences - 2D Payment Gateway. Settlement entrances promote smooth transactions by firmly processing payments in real-time